Clark Wealth Partners for Beginners

More About Clark Wealth Partners

Table of ContentsOur Clark Wealth Partners PDFs4 Simple Techniques For Clark Wealth Partners3 Easy Facts About Clark Wealth Partners ShownClark Wealth Partners Can Be Fun For AnyoneA Biased View of Clark Wealth PartnersThings about Clark Wealth PartnersUnknown Facts About Clark Wealth Partners

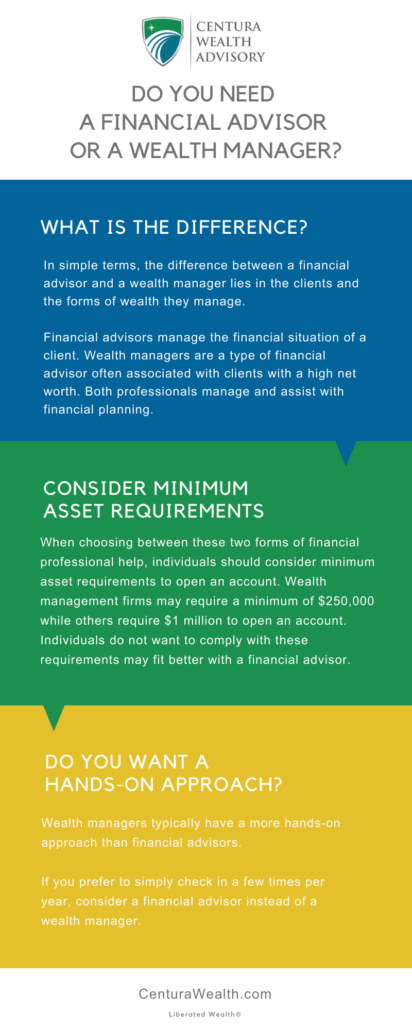

These are experts who provide financial investment recommendations and are signed up with the SEC or their state's safety and securities regulator. Financial experts can also specialize, such as in pupil lendings, elderly needs, taxes, insurance and various other aspects of your financial resources.Yet not constantly. Fiduciaries are legally required to act in their client's benefits and to keep their money and building different from other possessions they handle. Just financial consultants whose classification calls for a fiduciary dutylike qualified economic planners, for instancecan say the exact same. This difference likewise suggests that fiduciary and financial consultant fee frameworks differ also.

5 Easy Facts About Clark Wealth Partners Shown

If they are fee-only, they're a lot more likely to be a fiduciary. Several qualifications and designations need a fiduciary task.

Selecting a fiduciary will ensure you aren't steered towards specific financial investments because of the commission they supply - financial advisor st. louis. With great deals of money on the line, you might desire an economic expert that is legally bound to make use of those funds meticulously and just in your benefits. Non-fiduciaries might recommend investment products that are best for their pocketbooks and not your investing objectives

The Best Strategy To Use For Clark Wealth Partners

Learn more now on how to maintain your life and financial savings in equilibrium. Boost in cost savings the average home saw that worked with a monetary advisor for 15 years or even more compared to a similar house without a monetary advisor. Resource: Claude Montmarquette click now & Alexandre Prud'homme, 2020. "More on the Worth of Financial Advisors," CIRANO Task Reports 2020rp-04, CIRANO.

Financial recommendations can be useful at turning points in your life. When you meet with an adviser for the very first time, function out what you want to obtain from the recommendations.

A Biased View of Clark Wealth Partners

Once you've concurred to go on, your financial adviser will certainly prepare a monetary plan for you. This is offered to you at an additional conference in a file called a Declaration of Guidance (SOA). Ask the adviser to discuss anything you don't understand. You should constantly really feel comfy with your advisor and their advice.

Insist that you are alerted of all transactions, and that you receive all document pertaining to the account. Your consultant may recommend a handled optional account (MDA) as a means of handling your financial investments. This involves signing a contract (MDA agreement) so they can get or offer investments without having to consult you.

All about Clark Wealth Partners

To secure your money: Don't give your adviser power of lawyer. Urge all correspondence concerning your investments are sent to you, not simply your adviser.

If you're relocating to a brand-new adviser, you'll need to prepare to move your financial records to them. If you require assistance, ask your adviser to explain the procedure.

To load their footwear, the country will require even more than 100,000 new economic advisors to get in the industry.

Some Ideas on Clark Wealth Partners You Should Know

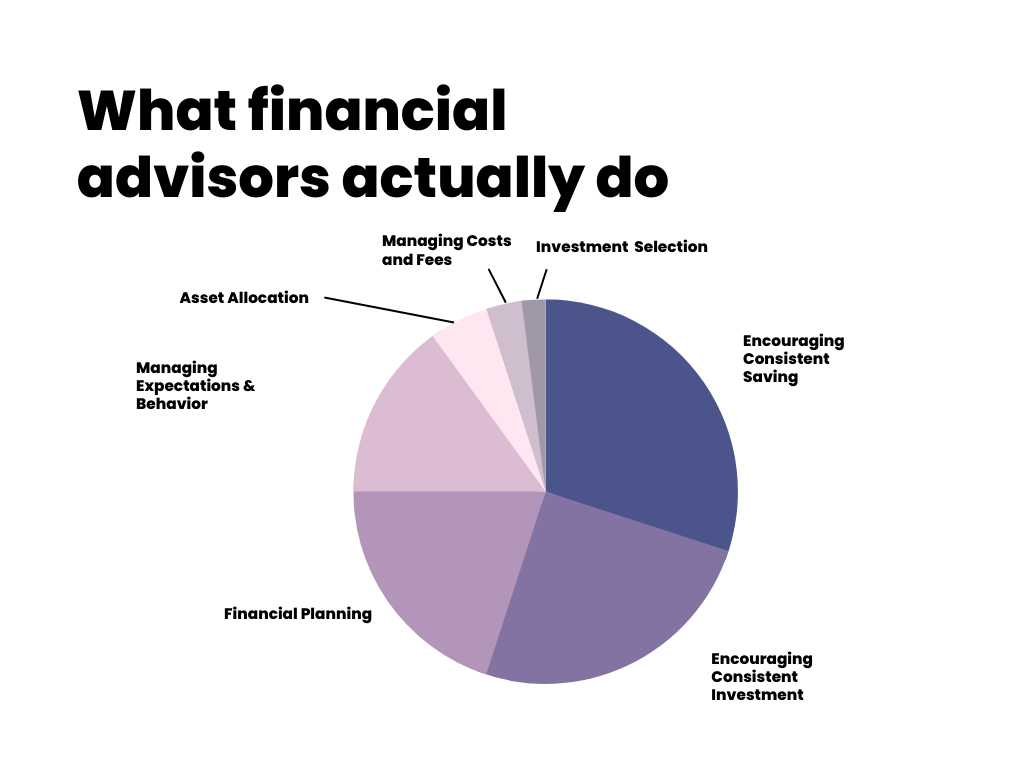

Aiding people attain their financial goals is an economic consultant's primary feature. They are also a small business owner, and a portion of their time is dedicated to managing their branch office. As the leader of their technique, Edward Jones financial experts need the leadership skills to work with and manage staff, in addition to the organization acumen to create and perform a service approach.

Financial consultants invest time each day seeing or reading market news on tv, online, or in profession magazines. Financial advisors with Edward Jones have the advantage of office research teams that assist them remain up to date on stock suggestions, shared fund management, and much more. Investing is not a "set it and forget it" activity.

Financial experts should schedule time each week to meet new people and catch up with individuals in their round. The economic services sector is greatly managed, and regulations change frequently - https://sandbox.zenodo.org/records/408042. Lots of independent financial consultants invest one to two hours a day on compliance tasks. Edward Jones monetary advisors are privileged the office does the heavy lifting for them.

Clark Wealth Partners - Questions

Edward Jones financial experts are motivated to seek additional training to broaden their knowledge and skills. It's also an excellent concept for economic experts to participate in sector meetings.